AML/CFT compliance guidelines for Saudi Arabia

- azakaw

- Dec 24, 2025

- 15 min read

Updated: Feb 6

AML in Saudi Arabia is no longer a compliance formality; it is a critical business risk.

Companies that fail to meet regulatory expectations face serious consequences, including money laundering charges in Saudi Arabia, frozen assets, and long-term reputational damage.

With enforcement intensifying and authorities applying strict risk-based scrutiny, money laundering penalties in Saudi Arabia can include heavy fines, imprisonment, business shutdowns, and deportation for foreign nationals. In many cases, weak controls or ignored red flags are enough to trigger investigations.

This article explains how Saudi Arabia’s AML framework works, what qualifies as money laundering, who enforces the rules, and what businesses must do to stay compliant in one of the region’s most demanding regulatory environments.

What is considered money laundering under Saudi law?

Under Saudi law, money laundering is any act involving funds known or reasonably suspected to come from criminal activity, carried out to conceal their origin or make them appear legitimate.

This includes transferring, using, acquiring, possessing, or attempting to disguise criminal proceeds, even if the person did not commit the original crime.

Money laundering is treated as a separate offence, and attempted laundering is punishable under Saudi Arabia’s Anti-Money Laundering Law (Royal Decree No. M/20).

Definition and elements of the offence

According to Royal Decree No. M/20, Saudi Arabia's Anti-Money Laundering Law (AMLL) takes a broad view of money laundering.

You commit this crime if you perform any operation with money that you know or have good reason to suspect comes from criminal activity.

This covers transferring, moving, using, retaining, or taking control of the cash. It also captures situations where you intend to conceal the true nature of assets, how they were obtained, where they are kept, or who owns them.

Knowing does not always mean confessing to AML provisions; judges can infer it from objective facts.

So if a deal seems dodgy and clear signs are pointing to why that is, but you go ahead anyway, they may decide you were fully aware (and thus complicit).

The legislation treats attempted laundering just as harshly as completed offences: even if money's illegal origins are exposed before the process is complete, simply trying to cover their tracks is enough for someone to be charged.

What is the difference between predicate offences and money laundering?

A predicate offence is the original crime that generates illegal funds, such as fraud, bribery, drug trafficking, or other violations of law.

Money laundering is a separate criminal offence that involves using, transferring, or concealing those criminal proceeds to make them appear legitimate.

In Saudi Arabia, a person can be convicted of money laundering even if they did not commit the predicate offence, and even if the original offender is unidentified or not convicted.

Legal framework: laws and authorities involved

In Saudi Arabia, regulations are made up of complex combinations of decrees, oversight bodies with lots of power, and rules that have been put into operation.

To protect yourself and your business from breaking the rules, you need to know which laws apply to you as well as who makes them.

Anti-Money Laundering Law of Saudi Arabia

The main law designed to stop money laundering was created when Royal Decree number M/20 of the year 1439H came into being - an event that took place back in 2017. There are also some rules for using the law ('Implementing Regulations').

Saudi Arabia has said goodbye to older laws about financial crime because this new legislation handles a lot more, like making sure there aren't any sneaky escape routes if baddies want to clean their ill-gotten cash.

This legislation provides extensive authority for tracking, seizing, and freezing monies; it lays down exactly what sort of actions would worsen penalties (like utilizing a position of governmental trust, or exploiting minors, or being part of organised crime).

By design, the law is meant to cover so much that there is no excuse if you break it by mistake.

Role of SAMA and the Saudi FIU

The Saudi Arabian Monetary Authority (SAMA) is the primary regulator of the financial sector. It issues mandatory circulars and guidelines that financial institutions, such as banks, insurance companies, and money changers, must follow.

SAMA also conducts regular, rigorous audits to ensure these firms are not being used as conduits for money laundering.

Working alongside them, but independently, is the Saudi Arabia Financial Intelligence Unit (SAFIU), often referred to simply as the FIU. Housed within the Presidency of State Security, it is the intelligence-analysis arm.

Businesses report suspicious financial transactions to the SAFIU; analysts there mine this data for intelligence value and possible links to organized crime or terrorist financing.

When they find something potentially actionable, they pass it on to law enforcement.

Involvement of Public Prosecution and criminal courts

If the FIU discovers a real danger, it hands the case over to the Public Prosecution. This institution boasts departments that deal only with financial crimes, called "specialized units".

While investigating such offences, they can do things like question suspects, grant arrest warrants, and freeze assets.

Trials take place at special criminal courts. To ensure money-laundering cases are dealt with swiftly, Saudi Arabia has set up particular circuits within its criminal court system.

These courts have judges who have special training when it comes to dealing with financial crime's complexities, making sure they understand schemes properly and rule on them in proportion to their seriousness.

Council of Ministers Decision No. 80 and FATF compliance

Saudi Arabia is keen to protect its global standing. The country has taken a series of steps, such as Council of Ministers Decision No. 80 and subsequent decrees, to bring its policies in line with those set by the Financial Action Task Force (FATF).

As a full member of FATF, Saudi Arabia's rules come up for regular inspection by its peers.

Because of this effort, Saudi authorities feel pressure to show they are "effective." Just having laws on the books is not sufficient; officials want to demonstrate high numbers of convictions and be able to confiscate a lot of assets.

This desire for international compliance helps explain why enforcement activity appears so aggressive: Businesses have no reason to expect leniency if they break the law in ways that could affect Saudi Arabia's FATF rating.

What are the AML compliance obligations for businesses in Saudi Arabia?

Businesses in Saudi Arabia must comply with strict AML obligations, including: identify and verify customers (KYC/CDD), apply enhanced due diligence (EDD) for high-risk clients, monitor transactions using a risk-based approach, and report suspicious activity without tipping off customers.

KYC, CDD, and enhanced due diligence (EDD)

Knowing who you're doing business with is basic to Saudi Arabia's anti-money laundering rules.

Proof of identity documents, such as National ID cards or Iqama, must be seen for all customers. However, that's just a start; you also need to investigate the type of business they operate and why they want to work with you, which means applying Know Your Business (KYB) procedures.

For categories with a higher risk factor, you will need to carry out Enhanced Due Diligence (EDD). This relates to individuals who are Politically Exposed Persons (PEPs), clients from nations with high-risk ratings, or those with complex ownership structures.

You must also be able to establish the Ultimate Beneficial Owner (UBO) by law; this is the actual person at the pinnacle of a corporate chain.

Any client failing to reveal their UBO cannot be engaged with.

Comply with Saudi Arabia laws

Say no to heavy fines and reputational damage!

With azakaw you can streamline AML compliance by respecting local and global regulations. Scale your business while reducing costs and complexity.

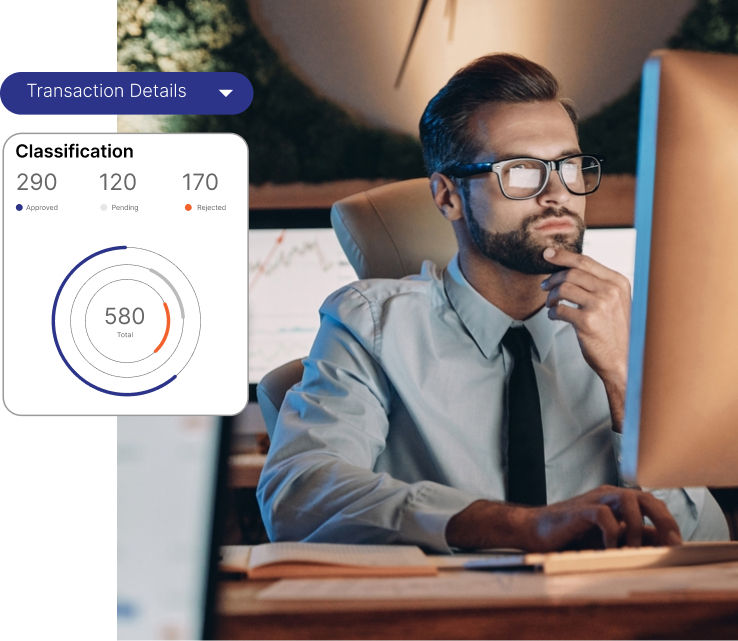

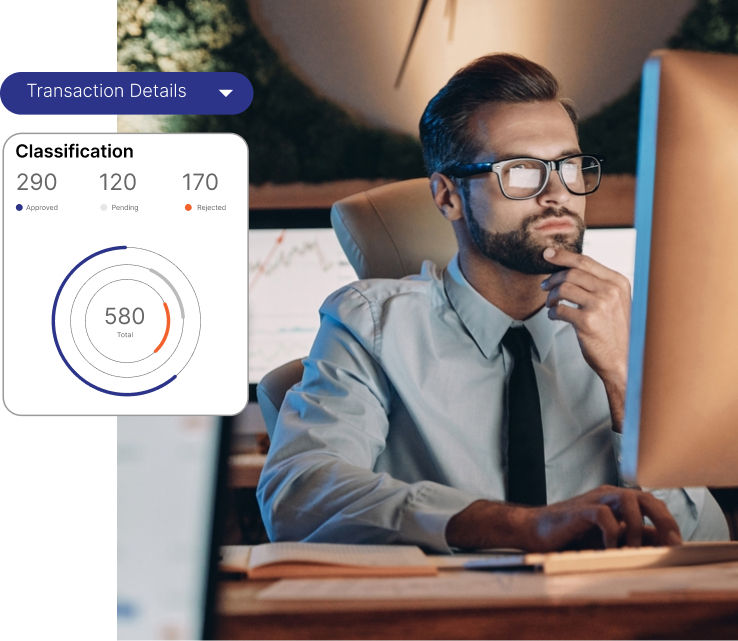

Transaction monitoring and risk-based approach

Applying the same checks to every single customer is a no-go area. The authorities insist on a Risk-Based Approach (RBA).

In practice, this means that you should assess the money laundering risks associated with each type of business your firm undertakes, depending on factors such as who its customers are, the kinds of goods they buy, and where they live.

For example, someone wanting to transfer millions out of a company account will require closer scrutiny than an individual taking out a savings policy with their monthly salary.

Financial institutions are required by law to have transaction monitoring systems in place.

These systems need to be both automated and can pick up on any unusual patterns; for example, an unexpected increase in cash deposits or fast transfers to completely unrelated third parties.

If your monitoring system is not up to scratch and misses obvious warning signs, SAMA or whichever regulator is relevant will come down on you like a ton of bricks for being negligent.

Suspicious transaction reports (STRs) and reporting requirements

If you see something that doesn't look right, you have the obligation to report it: the number one priority is lodging a Suspicious Transaction Report (STR).

In Saudi Arabia, this means going either via the RASD platform or speaking directly with SAFIU.

If you suspect that funds may be involved in crime or terrorism, or if their source cannot be explained in normal economic terms, you must report this without worrying about whether your suspicions are well-founded.

It is essential not to tip off the customer; that is, not to tell them that you have made a report: this would be an offence in itself.

You should make the report in such a way that the customer does not know; it is up to the authorities what action, if any, they want to take next.

What are the money laundering charges in Saudi Arabia?

If you are accused of a financial crime, things move quickly and harshly. The justice system takes a tough stance on financial crime — and its effects go beyond the courtroom.

Legal investigation process

An inquiry often begins with a dawn swoop or a call from the authorities. You may not have much notice – this is not like being involved in a civil case. Investigators have the authority to take away computers, phones, and papers.

You will be questioned about where the money came from. If you stay silent or seem cagey, this could count against you. Prosecutors build their cases on financial analysis, seeking evidence of differences between what you declare as income and your total assets.

Freezing of financial assets, detention, and denial of bail

If you are accused of money laundering, your assets will be frozen almost immediately.

The public prosecutor can instruct banks to block accounts, plus halt any share dealing or property transactions; so you can’t move funds around, or hide or destroy evidence.

Being held in custody is standard practice for money-laundering suspects.

During investigations, which can last six months (renewable) or even longer, it is rare for bail to be granted, especially if the sums involved are hefty or there are concerns about individuals fleeing the country.

Deportation for foreign nationals

Foreign nationals found guilty of money laundering can expect to be expelled from Saudi Arabia once they have served time behind bars and settled any outstanding court fines.

They will also join a blacklist barring re-entry at the border — either forever, or for a period decided by judicial authorities.

Travel bans and blacklisting

If charges have been filed against you, likely, you won’t be allowed to leave the Kingdom before your case is concluded. And if you’re convicted?

Say goodbye to any financial career. Those found guilty of money laundering will not only be banned from working in finance again, but they also can’t hold company directorships.

Public naming or shaming in court rulings

You are entitled to a lawyer, but when this right kicks in is crucial.

Although your solicitor can sit in during questioning, they are not allowed to speak for you. Their job is to make sure that fair procedures are followed and to check that any evidence presented does, in fact, prove what prosecutors claim.

In Saudi Arabia, defense lawyers have a crucial role in contesting the element of "knowledge"; showing there was no way you could have known money was dirty.

You do get access to the case file, but frequently only after the initial investigation phase has ended.

What are the money laundering penalties in Saudi Arabia?

Money laundering penalties in Saudi Arabia are severe and can include: long prison sentences, substantial financial fines, freezing and confiscation of assets, and business shutdowns or licence revocation.

Foreign nationals face mandatory deportation after serving their sentence, along with possible travel bans and blacklisting, making the consequences both criminal and long-term.

How to avoid money laundering risks in Saudi Arabia

It is vital that you construct a stronghold of compliance around your enterprise that will prevent money laundering.

By doing so, you will shield yourself from both criminal exposure and regulatory retribution.

AML red flags and best practices for businesses

You need to educate yourself and your team to recognize some common signs of money laundering, for example:

customers who seem unusually secretive about their income sources;

transactions that simply don’t fit with what you know of the client (like a student moving millions of dollars);

a series of transfers that are just below an amount at which reporting is required.

Also, be cautious if clients ask for cash when conducting large deals or if they want business conducted via third parties who don’t appear connected to them.

One major financial institution tells its staff members not to process any payment that “doesn’t make commercial sense” until it has received an acceptable explanation, if ever!

Importance of robust KYC and transaction monitoring systems

Using manual spreadsheets for KYC and monitoring purposes is no longer enough. What you need are automated systems that screen clients in real-time against sanctions lists such as those from the UN and local authorities.

Your transaction monitoring system should be dynamic, able to adapt as new typologies of financial crime emerge.

A robust system will provide an audit trail, demonstrating to SAMA that you did everything reasonable to prevent a crime (this can be crucial as part of a defense).

Orboard new customers

Create customised onboarding flows and verify individual customers or legal entities with ease while reducing fraud risk with our AI-powered solution.

Ongoing employee training and reporting obligations

The people who work for you are your primary means of defense.

From the receptionist to the board members, everybody needs ongoing training. They must be able to recognize warning signs of money laundering, specifically in your sector.

It's also important that they know what their reporting duties are.

Create a culture that makes it clear: "telling us about a suspicious transaction is not breaking a confidence with our clients" – it is fulfilling an obligation.

Challenges in implementing AML measures in Saudi Arabia

Even though the laws there are sound, making them work in practice throws up obstacles. Identifying these challenges helps firms prepare for operational snags and use resources more efficiently.

Shortage of specialised AML professionals

Compliance departments have a major headache: finding people with the right skills.

While lots of Saudis have been helped into work by Saudization (Nitaqat), financial crime compliance is so specialist that it takes years to get good at it.

The result? There aren’t sufficient qualified Saudi nationals who grasp both local rules and global trends, such as money laundering methods; when they do understand these issues well after being hired, staff often move on.

Firms then start competing fiercely for their replacements, which can mean junior employees end up doing jobs beyond their capabilities, missing complex fraud as a result.

High operational cost of compliance for SMEs

While large banks consider money-laundering checks as a normal cost of doing business, small jewellers and auditing firms find the financial burden excessive.

Profit margins can quickly dwindle once smaller companies start using automated transaction screening software, employ someone full-time to ensure compliance, or conduct their own regular audits; all measures typically required by law.

In practice, many such outfits choose to meet these obligations manually, but this often proves expensive when they make mistakes and are fined as a result.

Read also:

Informal remittance systems

Saudi Arabia has lots of guest workers who send a good chunk of their wages back home.

Although there are rules regulating where money service businesses can operate and how they must conduct transactions, plus official channels like banks through which funds can be moved, some expats still prefer to give cash to hawala brokers.

Because authorities cannot easily track them through financial records, it is very hard to keep tabs on these funds.

For companies, one danger is inadvertently becoming linked to these unofficial channels if they accept payments that have entered the country in this way.

Growing complexity in cross-border transaction monitoring

Saudi Arabia is opening its doors to the world, wooing foreign investors and visitors. But all this new economic activity makes life more complicated still.

These days, monitoring money as it moves across borders doesn’t just mean keeping tabs on cash destined for dodgy nations.

A case in point is trade-based money laundering, where cash is made to look like cash from “proper” business by moving it around via fake invoices for goods or services.

As well as such traditional fiddles, there are concerns about nefarious cash being flung into the country via these digital channels; if mainstream banks start accepting large quantities of such dosh, there is a risk they could become hooked up to the same switchboards as international terrorists!

Stay ahead of risk with azakaw

Discover how our AI-powered intelligent transaction monitoring software deals with high transaction volumes and cross-border activities to detect risks and reduce fraud and compliance costs.

Notable money laundering cases in Saudi Arabia

Although the names of individuals are usually not disclosed until legal proceedings have concluded, the methods used by authorities in bringing charges show where they are directing their efforts.

Knowledge of these cases can help people avoid making similar mistakes.

High-profile examples and corporate cases

In recent years, there have been major clampdowns on organised criminal networks that include both Saudi nationals and foreign workers, with one common feature being the use of tasattur (commercial cover) by expats who front businesses for laundering cash that actually belongs to a citizen.

An interesting pattern highlighted by Nazaha, the Oversight and Anti-Corruption Authority, concerned groups sending billions of Riyals overseas via shell firms that carried out no genuine business.

Fake import invoices were used by these groups to justify large transfers, or bank employees were bribed to turn a blind eye to standard KYC protocols, allowing the laundering of millions in cash.

Ringleaders received jail terms of more than 15 years and multi-million-dollar fines.

Lessons learned for financial institutions and professionals

One key point from all this is simple: saying you didn't know the rules against money laundering doesn't get you off the hook.

Many of the institutions that got hit with big fines had anti-money laundering policies in place, but they just weren't doing enough to make them work.

For example, they routinely ignored alerts from their own computer systems that track dodgy transactions.

But there's also a wider message for anyone working in finance.

If you let someone else use your name or licence to help them move dirty money, then you too are breaking the law on cleaning up crime – even if, like most people, you never actually come into contact with the proceeds of any illegal act yourself.

Frequently Asked Questions

Is money laundering a criminal offence in Saudi Arabia?

Yes, money laundering is a serious criminal offense there.

According to the Anti-Money Laundering Law, those suspected of this crime can be taken into custody and held in detention.

It is considered to be a stand-alone offense, meaning you could be found guilty even if authorities do not fully prosecute you for how funds were originally obtained through illegitimate means.

Can a foreigner be charged with money laundering in Saudi Arabia?

Certainly, non-Saudis are bound by the same legislation as Saudi citizens. If someone from overseas is convicted, they can expect prison time, stiff monetary penalties, and once these have been served, deportation. Permanently excluded, too; entry will never again be allowed.

Do you have to commit the predicate offence to be guilty of money laundering?

No. In Saudi Arabia, money laundering is an independent offence.

A person can be convicted of laundering even if they did not commit the predicate offence that generated the illegal funds.

What is the role of SAMA in AML enforcement?

SAMA is the supervisory authority for financial institutions. They give guidelines on AML/CTF, visit companies to check they are following the rules, and can fine banks or insurers heavily if they do not have enough controls/reporting systems for AML.

What should I do if I’m under investigation for money laundering in Saudi Arabia?

You must find a lawyer with a license to practice in Saudi Arabia straight away.

Ideally, this person will have experience with financial crimes. It is illegal for you to hide things that belong to you or get rid of documents at this time; that would be another crime on top of everything else.

You have every right to have a solicitor advising while investigations continue; make sure you cooperate fully with their inquiries.

How long can authorities freeze assets in AML cases?

Initially, the Public Prosecution has the power to freeze assets while they investigate.

If the case goes to court, this can be extended up until the trial concludes. Should a conviction be secured, any frozen assets will be seized permanently.

How are suspicious transactions reported in Saudi Arabia?

If you suspect a transaction, you must report it straight away.

Reports can be made via the RASD system or directly to the General Directorate of Financial Intelligence (SAFIU).

Remember: don’t tell anyone you have filed a report; it’s strictly confidential!

Can money laundering charges lead to deportation?

Yes, non-Saudi nationals will be deported as an additional punishment following any prison sentence handed down, plus payment of fines.

You’ll also go onto a watchlist, meaning officials can stop you from returning in the future.

Conclusion

AML in Saudi Arabia is enforced with zero tolerance for weak controls or informal compliance. Authorities focus not only on criminal intent, but on whether businesses took reasonable steps to prevent abuse.

In this context, poor KYC, limited transaction monitoring, or delayed reporting can quickly lead to money laundering charges in Saudi Arabia.

Given the severity of money laundering penalties in Saudi Arabia, compliance must be continuous, automated, and defensible.

For businesses operating in or with the Kingdom, the safest path forward is an end-to-end compliance approach that combines KYC, KYB, risk scoring, and transaction monitoring in a single system. Modern AML is no longer optional; it is a core operational requirement.

The End-to-End Compliance Platform

Streamline compliance from KYC & KYB to corporate compliance and AML transaction monitoring, reducing costs and complexity so you can scale with confidence.

Key takeaways about AML in Saudi Arabia |

|

|

|

|

|

|

Related articles: